|

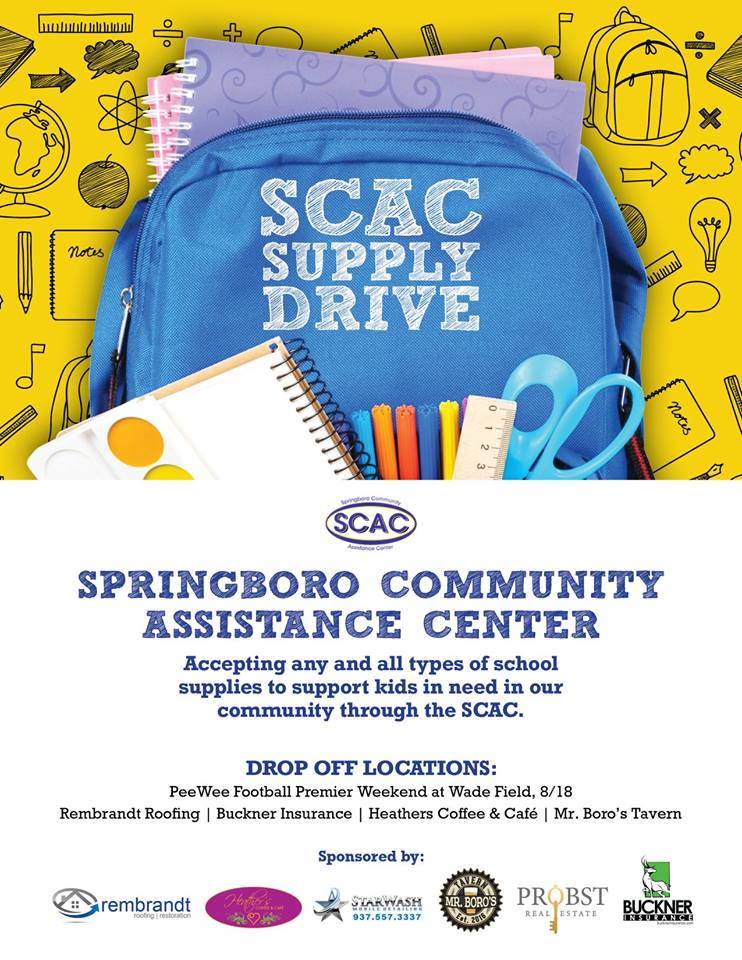

This was a busy weekend for Buckner Insurance! Charity kickball on Saturday and then presenting sponsor of the 1st Annual Jim Cleamon’s Celebrity Outing Pairing Party on Sunday, followed by the Golf Outing on Monday. We love our community and we love to be involved, so this was a weekend we were very excited about. The pairing party was held in Dayton at Top of the Market. Our front girl Brittany won 2 signed basketballs in the silent auction! We also had 2 teams that played in the outing. Here are some photos from the party and the outing. We ran into our favorite home builders from Catalyst Homes. If you haven’t already, you have to check them out. Their homes are gorgeous. And everyone knows our friend Eric from Flyin’ To The Hoop. He’s a celebrity himself! Every year, the Young Professional Groups around the area get together and compete in a sporting event to raise money for a local charity of choice. Buckner Insurance has had the opportunity to be one of many sponsors to this event for the 2nd year in a row. The Buckner girls not only competed in this year’s tournament, they also helped plan and organize it with the Young Professionals at Austin Landing. Kelsey and Brittany actually serve on the YPAL board. This year’s event was a kickball tournament to benefit Crayons to Classrooms!! The Buckner girl’s team did not win, but they had a great time being involved. We are looking forward to next year’s event. If you are interested in joining a young professionals group, there are so many amazing ones around here like the Young Professionals At Austin Landing, Springboro YP, Dayton Sportcial, and Generation Dayton. Great networking opportunities as well as charity. Until next year YP cup! We are so happy that some of our favorite Springboro businesses have asked us to team up to collect school supplies!! We already have a box half-filled!! You guys are the best and so are these businesses!! Rembrandt Roofing & Restoration, LLC StarWash Mobile Detailing Heathers Coffee and Cafe Mr. Boro's Tavern Probst Real Estate - Keller Williams Advantage, Springboro Community Assistance Center (SCAC).

LET'S TALK WATER...Did you know that floods are the Nation’s most common and costly natural disaster and that your standard property coverage does not cover it?

Flood insurance must be purchased separately and the most recent poll done by the Insurance Information Institute showed only about 12% of US homeowners actually have it. We don’t want this percentage to be so low simply because of the assumption most people have that it’s automatically covered. So let’s focus on the ins and outs of water damage and coverage. Do I Need Flood Insurance? As you know the weather can be very unpredictable and according to FEMA all 50 states have experienced floods or flash floods in the past 5 years. Flooding can occur from storms, over saturated ground, overflowing or surging bodies of water like rivers, ponds, and, lakes. A flood could very well happen to anyone. A flood with no insurance could leave you financially devastated. The damage from just one inch of water can cost more than $20,000. More than 20 percent of flood claims come from properties NOT located in high risk flood zones. If you own, or are looking to purchase a personal or commercial property in a high flood zone your lender will actually require you to carry it. Flood insurance for homes in non-flood zones is surprisingly very affordable with a few different coverage and deductible options. Is my Car covered if there’s a flood? Streets flooding are more common than you think and can easily total a car. Unless you carry Comprehensive coverage your car is not covered for it. Comprehensive coverage comes with a deductible and covers not only flooding but things like fire, hail damage, if you hit a deer, and broken glass. You can have comprehensive coverage without collision. If you just carry liability only it’s a good idea to call your agent and ask how much more it would cost to add comprehensive coverage to it. It is a very low cost coverage! How do I get a Quote for Flood Insurance? Anyone with a residential or commercial policy with a property located in a NFIP- participating community can purchase flood insurance. Purchasing flood insurance is easy. You can contact agents who offer it, like us! All we need to get started on a quote is your name and property address. We will be able to recommend different coverage options and deductibles. It is important to know that unless it is a new purchase and required for a loan closing, you will typically have a 30 day wait period for coverage. So call now! Do not wait until it’s too late!! All flood insurance is written through FEMA through the National Flood Insurance Program so it is not something you can shop for different rates. All agents authorized to sell flood insurance will have the exact same price. The Exception… It is correct that flooding is not covered by homeowners, condo, and renters insurance. The exception to that is one of our companies Auto Owners Insurance, does in fact offer what is called “Inland Flood Coverage”. This can be added to homeowner’s policies as an endorsement. These properties must not be located in high risk flood zones and the limit must match the policies water backup limit. It would then give a small amount of coverage for flooding. What is Water Backup of Sewers and Drains? A residential and commercial property policy will cover what’s called “Water Backup of sewers and drains” if endorsed to be added to the policy. It is not an automatic coverage. This is different water scenario than flooding we discussed earlier. What this covers is repairing water damage from overflowing drains and sewers, broken sump pumps, and more. Typically, when a sump pump fails it causes water to backup into your home, sometimes bringing all kinds of water-borne materials with it. A water backup can create costly damage. This leaves you to have to quickly arrange for cleanup and repairs to avoid further damage. Water backups can happen to anyone! It is a good idea to call your agent and make sure you have the coverage and find out your limit. We recommend in most cases a very minimum of $10,000 -$25,000 coverage. Are the pipes in my front yard covered if they bust? Not unless you have the specific coverage added and not all companies have it available. Several of our companies will offer what is called “Service Line Coverage”. This will actually cover the pipes in your front yard leading from the street in the event the bust for any reason. This is a very common claim and another great misconception of something most believe to be automatically covered by their homeowners insurance. All of these things are just additional reasons why it is a great idea to review your policies with your agent every year at renewal. Things change and you don’t want to find out after the fact that you weren’t covered. We will review your policy even if you are not our current client and give you suggestions. Buckner insurance is an authorized flood insurance agency and we are here to help! Please contact us if you have any questions: 937-434-6800 |

The Buckner BuzzKeep up with all things Buckner Insurance! Upcoming events, insurance news, and "The Buzz" around the Buckner office that we'd like to share with you! Archives

September 2023

Categories

All

|

- Home

- Services

- About Us

- Personal Insurance

-

Business Insurance

- Contractors Insurance

- Restaurant Insurance

- Marina Insurance

- Church Insurance

- Wedding & Event Insurance

- Retail & Boutique Insurance

- Remediaton & Restoration Contractors Insurance

- Manufacturing Insurance

- Landscapers Insurance

- Trucking Insurance

- Repair Shop Insurance

- Salon Insurance

- Gas Station Insurance

- Commercial Building Insurance

- Sports & Fitness Liability Insurance

- Referral Rewards

- Request A Quote

- The Buckner Buzz

- (937) 434-6800

|

Website by Berry Digital Solutions, LLC

|

RSS Feed

RSS Feed